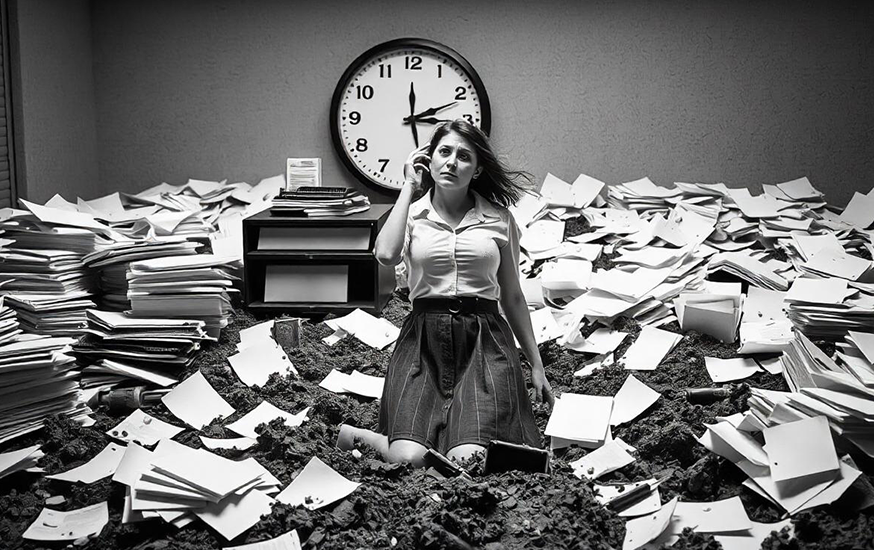

Every time you dive into another round of spreadsheets and invoices, your firm’s growth takes a step backward. It’s not the complexity of the work that’s the problem—it’s the daily grind that’s quietly killing your potential. Whether it's balancing the books, reconciling accounts, or managing payroll, accounting firms can easily get bogged down in the day-to-day tasks. These essential but time-consuming tasks may be the “engine” that keeps the firm running, but they're also the “mud” that holds it back from driving toward innovation and growth.

Let’s dig into how bandwidth issues can kill creativity and growth, and more importantly, how you can hit the gas pedal and get unstuck

The Bandwidth Drain: Like Running on Empty

Imagine trying to drive across the country with barely enough fuel in your tank. Sounds like a recipe for disaster, right? Now picture your accounting firm as that car. When your team is consumed by routine tasks, it’s like running on fumes—there’s no extra fuel for innovation, strategic thinking, or even growing your business.

Bandwidth is a precious resource. When it’s all used up by mundane accounting tasks, it leaves little room for the kind of creative, high-level thinking that drives real progress. Firms that don’t outsource their accounting often find themselves with “empty tanks,” constantly scrambling to stay on top of the workload, leaving no time or energy for strategy, growth, or improving client relationships.

And we all know what happens when your car runs out of gas—it stops. The same applies to your firm’s growth.

The Creative Drought: Innovation Stuck in Neutral

When all hands are on deck just to keep the books balanced, creativity takes a back seat. It’s like having a high-performance sports car and never taking it out of second gear, what’s the point? You’re equipped with a talented team, but if they’re stuck handling routine, repetitive tasks, you’re wasting potential.

Accountants are more than number crunchers, they’re also problem solvers, advisors, and strategists. But if they're bogged down with tasks like processing payroll or handling reconciliation, there’s no bandwidth left for the work that really moves the needle

Outsourcing allows your team to shift into high gear. By letting an outsourced partner handle the time-consuming processes, you free up mental bandwidth for your team to focus on innovation, building stronger client relationships, and strategic planning. It's like giving your firm a turbo boost, pushing it beyond its current limits.

The Paradox of Overload: Too Busy to Grow

Ever noticed that when you're too busy keeping up with the day-to-day, the bigger picture starts to blur? This paradox of being too busy to focus on what really matters is something many accounting firms face. It’s like trying to steer a ship through rough waters while being stuck below deck fixing leaks.

You’re so consumed by urgent tasks that you don’t have the capacity to think about the future or steer your firm toward new opportunities. Growth doesn’t happen just by keeping things afloat—it requires strategic focus, planning, and execution.

Outsourcing accounting services can be like hiring a crew to handle the leaks, freeing you up to focus on where you're headed. It’s not just about freeing time; it’s about freeing mental space to take a step back and ask, “Where can we innovate?” and “How can we grow?”

Bandwidth Constraints: The Silent Growth Killer

Let’s talk about the hidden killer of growth—bandwidth constraints. These constraints can sneak up on you, slowly eroding your firm’s ability to expand, take on new clients, or implement new technology.

Imagine a sprinter trying to run a race with weights tied to their ankles. Sure, they might make it to the finish line, but they’ll be slower, more exhausted, and less likely to win. This is what happens to firms that try to handle everything in-house without outsourcing.

Every hour spent reconciling a client's books is an hour not spent exploring new revenue streams, experimenting with technology, or finding ways to serve clients better. These are the areas where true growth lies, and if your team’s bandwidth is maxed out, those opportunities pass you by.

By outsourcing accounting tasks, you shed weight, giving your firm the agility and speed to keep up with the market's demands.

Outsourcing: The Fuel for Creative Growth

Now that we’ve looked at how bandwidth issues are draining your firm's creative fuel, let's explore the solution - outsourcing. It’s more than just a quick fix. Think of it as installing a nitro-boost for your firm, freeing up valuable resources that can be redirected toward innovation, client relationships, and growth.

When you outsource your accounting functions, you allow your in-house team to focus on higher-value work. This could mean more time spent analyzing data to provide deeper financial insights, creating strategies that lead to better client outcomes, or simply brainstorming new ways to drive business growth.

Not to mention, outsourcing brings specialized expertise and technology into the mix, optimizing processes and providing your firm with the efficiency and innovation needed to stay competitive in a fast-evolving marketplace.

Shifting Gears Toward Innovation

Accounting firms are being bogged down by bandwidth issues, stuck in the mud of the daily grind. Without enough fuel in the tank, innovation and growth can come to a grinding halt. But by outsourcing, you can free your firm from the constraints that hold it back, unlocking new levels of creativity, efficiency, and growth.

It’s time to rev up your firm’s potential. Free yourself from the daily grind and start steering toward a future of unlimited possibilities. Because when you clear the mud, the road to innovation is wide open.

Shekhar Mehrotra

Founder and Chief Executive Officer

Shekhar Mehrotra, a Chartered Accountant with over 12 years of experience, has been a leader in finance, tax, and accounting. He has advised clients across sectors like infrastructure, IT, and pharmaceuticals, providing expertise in management, direct and indirect taxes, audits, and compliance. As a 360-degree virtual CFO, Shekhar has streamlined accounting processes and managed cash flow to ensure businesses remain tax and regulatory compliant.

You might also like:

Listen Exclusive Podcast On