Let’s start with a simple truth:

A company can show great profits… and still be short on cash.

Sounds strange, right?

But it happens more often than you think. That’s exactly why experienced investors, lenders, and finance professionals pay close attention to Free Cash Flow (FCF).

While profit tells you how a company performed on paper, free cash flow tells you how much real money the business actually generated.

So, what exactly is Free Cash Flow?

Free Cash Flow is the cash a company has left after paying its day-to-day expenses and investing in assets like machines, equipment, or buildings.

This leftover cash can be used to:

• pay dividends to shareholders

• repay loans

• save for tough times

• invest in growth

Unlike profit, FCF is about real money in the bank, not accounting adjustments.

A commonly taught idea in corporate finance says that:

“Free cash flow represents the cash a company can distribute to investors without harming its ability to operate.”

- The Intelligent Investor, Book by Benjamin Graham

Why people look at Free Cash Flow instead of profit

Profit (or net income) includes things like:

• Depreciation

• Amortization

• Accounting estimates

These reduce profit but don’t reduce cash.

Free cash flow ignores the noise and focuses on: Actual cash coming in and going out.

That’s why many investors say: “Earnings tell a story. Cash tells the truth.”

Free Cash Flow formula

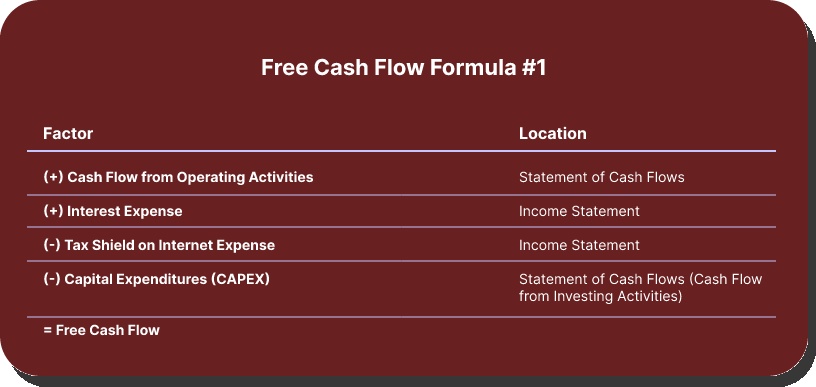

Formula 1:

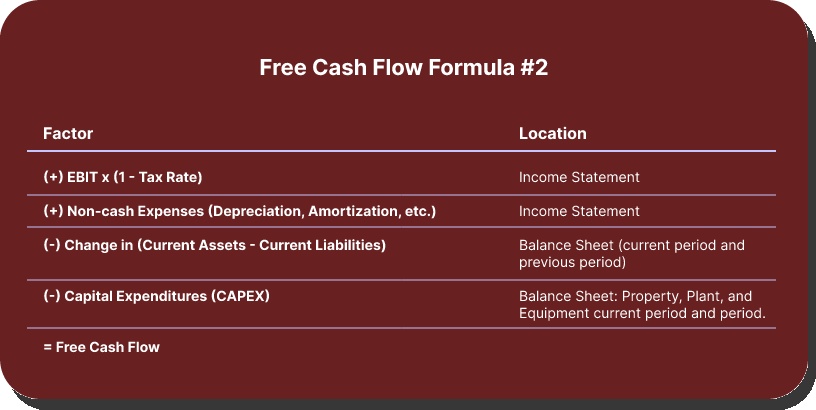

Formula 2:

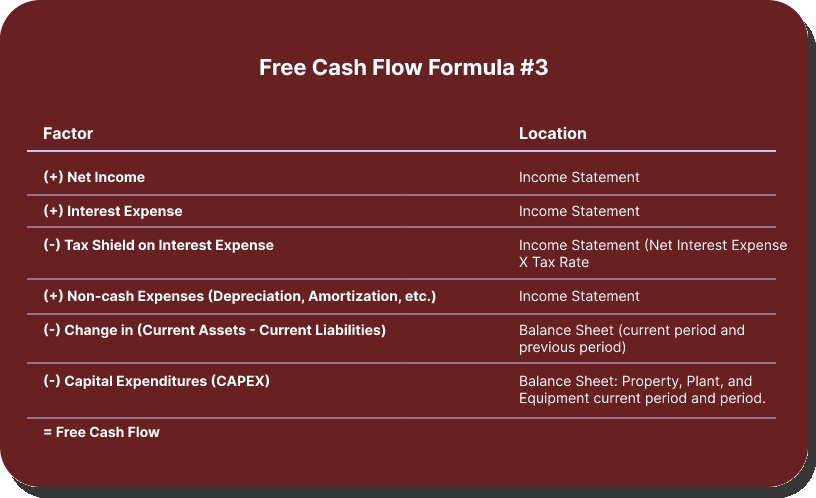

Formula 3:

What Free Cash Flow Really Reveals (That Profit Often Hides)

Here’s where free cash flow becomes truly powerful.

A company can look perfectly healthy on the income statement for years steady revenue, growing profits, rising EPS and still be quietly struggling underneath. That’s because profit shows performance, but free cash flow shows pressure.

Let’s walk through a simple scenario.

When Profit Looks Stable, but Cash Tells a Different Story

Imagine a company that reports $50 million in net income every year for 10 years.

On the surface, this looks like a dream business:

• Consistent earnings

• Predictable performance

• No obvious red flags

Most investors would assume the company is financially strong.

But now imagine you look at its free cash flow trend, and you notice something worrying:

• FCF has been falling for the last two years

That gap between profit and cash is a signal and signals are what smart investors pay attention to.

What Could Falling Free Cash Flow Be Telling You?

When FCF drops, it usually means cash is getting stuck or squeezed somewhere. Common reasons include:

1. Inventory is piling up

The company is producing or buying more goods than it can sell.

• Cash goes out to buy inventory

• Products sit unsold

• Cash doesn’t come back quickly

Profit may still look fine, but cash is locked on shelves.

2. Customers are paying late

To boost sales, the company may be offering longer credit terms.

• Revenue is recorded

• Profit looks strong

• Cash hasn’t actually arrived

Accounts receivable increase, pulling down FCF.

3. Suppliers want faster payment

If vendors lose confidence, they may shorten credit terms.

• Accounts payable go down

• Cash leaves the business sooner

Another hit to free cash flow.

In all these cases, nothing looks wrong on the income statement, but free cash flow starts waving a red flag.

Why Lenders and Investors Love Free Cash Flow

When a company consistently generates strong free cash flow, it signals one important thing:

the business is producing real cash, not just accounting profit.

This makes it much easier to answer practical questions like:

• Can this company pay its debt comfortably?

• Are future dividends sustainable?

• Is growth being funded by real cash or just accounting profit?

For lenders

When free cash flow is healthy, lenders gain confidence.

By looking at Free Cash Flow to the Firm (FCFF) and subtracting existing debt payments, lenders can see how much cash is truly available to:

• Current service loans

• Safely take on additional debt

This helps lenders judge risk, not just profitability.

For shareholders

Strong free cash flow also reassures shareholders.

If free cash flow remains solid after interest payments, shareholders can reasonably expect:

• More stable dividends

• Less reliance on borrowing to reward investors

In short:

Profit shows ability.

Free cash flow shows reliability.

Shekhar Mehrotra

Founder and Chief Executive Officer

Shekhar Mehrotra, a Chartered Accountant with over 12 years of experience, has been a leader in finance, tax, and accounting. He has advised clients across sectors like infrastructure, IT, and pharmaceuticals, providing expertise in management, direct and indirect taxes, audits, and compliance. As a 360-degree virtual CFO, Shekhar has streamlined accounting processes and managed cash flow to ensure businesses remain tax and regulatory compliant.