Running an online store in the U.S. is exciting, but let’s be real keeping track of every sale, refund, shipping fee, and tax can quickly get overwhelming. One moment, you’re checking orders on Shopify, the next you’re trying to make sense of Amazon settlement reports or juggling multiple state sales taxes. And that’s before you factor in inventory across different warehouses or dropshipping partners.

If this sounds familiar, you’re not alone. Many e-commerce owners spend hours buried in spreadsheets, trying to reconcile payments, calculate COGS, or track sales tax obligations. That’s where outsourced e-commerce accounting comes in. By partnering with specialists, you can get clarity on your finances, make smarter business decisions, and free up time to focus on growth.

Why E-Commerce Accounting is Different from Traditional Accounting

You might think, “Accounting is accounting what’s so different about online stores?” But here’s the thing: e-commerce is a different beast entirely. Let’s break it down.

1. Multi-Channel Sales Complexity

Many e-commerce businesses sell on Shopify, Amazon, eBay, Walmart, Etsy, or all of the above. Each platform has its own payout schedules, fees, and reporting formats, and trying to reconcile them manually is time-consuming and error prone. Outsourced accounting firms integrate these channels so your sales data flows into one system, accurately reflecting your revenue and fees.

2. Inventory Tracking Across Locations

Whether you’re using Fulfillment by Amazon (FBA), dropshipping, or multiple warehouses, keeping tabs on inventory is crucial. Accurate Cost of Goods Sold (COGS) and stock levels are essential for pricing products, managing cash flow, and avoiding overstock or stockouts.

3. Sales Tax Across States

In the U.S., sales tax rules vary by state, county, and even city. Selling in multiple states can create a web of obligations, and missing filings could lead to penalties. A specialized e-commerce accountant ensures you stay compliant with multi-state sales tax regulations, saving you from costly mistakes.

4. High Transaction Volumes

E-commerce businesses can process hundreds or thousands of transactions monthly. Managing all of these manually increases the risk of mistakes and missed revenue. Automation, combined with expert accounting, ensures accuracy and real-time visibility.

5. Global Transactions and Currencies

If you’re selling internationally, currency conversions, foreign transaction fees, and international tax compliance add another layer of complexity. Outsourced accountants can track these seamlessly, giving you a clear picture of profitability across borders.

How Outsourced Accounting Helps U.S. E-Commerce Businesses

Outsourced accounting firms, like ProcStat, take the stress out of managing e-commerce finances. Here’s a detailed look at how specialized accounting services benefit your business:

1. Cost Efficiency:

Hiring an in-house accounting team isn’t cheap. Between salaries, benefits and ongoing training, costs can add up quickly, especially for small to mid-sized online stores. Outsourcing can save up to 60% on overhead costs, letting you access expert accounting services without the extra expenses.

2. Industry Expertise:

Your average accountant might not fully understand Amazon settlement reports, Shopify fees, or multi-state tax compliance. Professional e-commerce specialists, however, know the ins and outs of online retail, ensuring your books are accurate and actionable.

3. Accurate Financial Records:

Good e-commerce accounting goes beyond the basic monthly P&L statement. It breaks down your business by product, sales channel, region, and even marketing campaigns. This level of detail allows you to:

• Identify which SKUs are driving revenue

• Track which sales channels are most profitable

• Understand the cost of returns and refunds

• Analyze how marketing spend impacts ROI

Example: You might discover that a specific product performs well on Etsy but not on Amazon. With accurate, granular reporting, you can make informed decisions like adjusting your ad spending or discontinuing unprofitable SKUs.

4. Tech-Savvy Accounting

Manual reconciliation across multiple platforms is a recipe for errors. Professional e-commerce accountants leverage tools like QuickBooks, Xero, Zoho Books, and NetSuite to automate transactions, track multi-channel sales, and maintain tax compliance.

Automation not only reduces human error but also provides real-time insights into your finances. You can check your dashboards anytime to see revenue trends, cash flow status, or inventory updates.

Example: If a customer requests a refund, an automated system can adjust your books, update inventory, and ensure the refund is accounted for in your financial reports, saving hours of manual work.

5. Cash Flow Management

Even if your revenue looks strong, e-commerce cash flow can be tricky. Between delayed marketplace payouts, advertising expenses, and inventory purchases, it’s easy to lose track of available cash.

E-commerce accounting specialists help monitor key metrics, such as SKU-level profitability, break-even points, and expected inflows and outflows. This allows you to plan when to restock inventory, adjust ad spending, or launch promotions without risking a cash crunch.

Example: Your store might have $50,000 in sales for the month, but $30,000 is tied up in pending marketplace payouts and inventory purchases. Accurate financial analysis shows your actual cash position, helping you avoid overcommitting on new purchases.

6. Scalable Support

As your e-commerce business grows, so do your accounting needs. Adding new sales channels, products, or international markets can quickly complicate financial management.

Professional e-commerce accounting services are scalable, they grow with you. Whether you expand to new marketplaces, start selling internationally, or increase inventory volume, they can handle:

• Cross-border taxes and currency conversions

• Complex inventory management across warehouses

• Advanced cash flow forecasting for multi-channel operations

Example: A store selling on Shopify wants to expand to Walmart and Etsy. A scalable accounting system can integrate the new channels, reconcile sales automatically, and update reporting, so the business owner doesn’t have to worry about managing multiple accounting systems.

Key Components of E-Commerce Accounting

To really understand the value of outsourcing, here’s what specialized e-commerce accounting covers:

1. Sales Recording: Accurate tracking across all platforms.

2. Vendor Invoice Processing: Timely and correct payments to suppliers.

3. Sales Channel Reconciliation: Matching payments from Shopify, PayPal, Stripe, etc.

4. Cost of Goods Sold (COGS): Including product costs, shipping, packaging, and platform fees.

5. Inventory Management: Real-time tracking across warehouses and fulfillment centers.

6. Financial Reporting: Dashboards with insights on revenue, profit margins, and SKUs.

7. Tax Compliance: Multi-state and international sales tax filings.

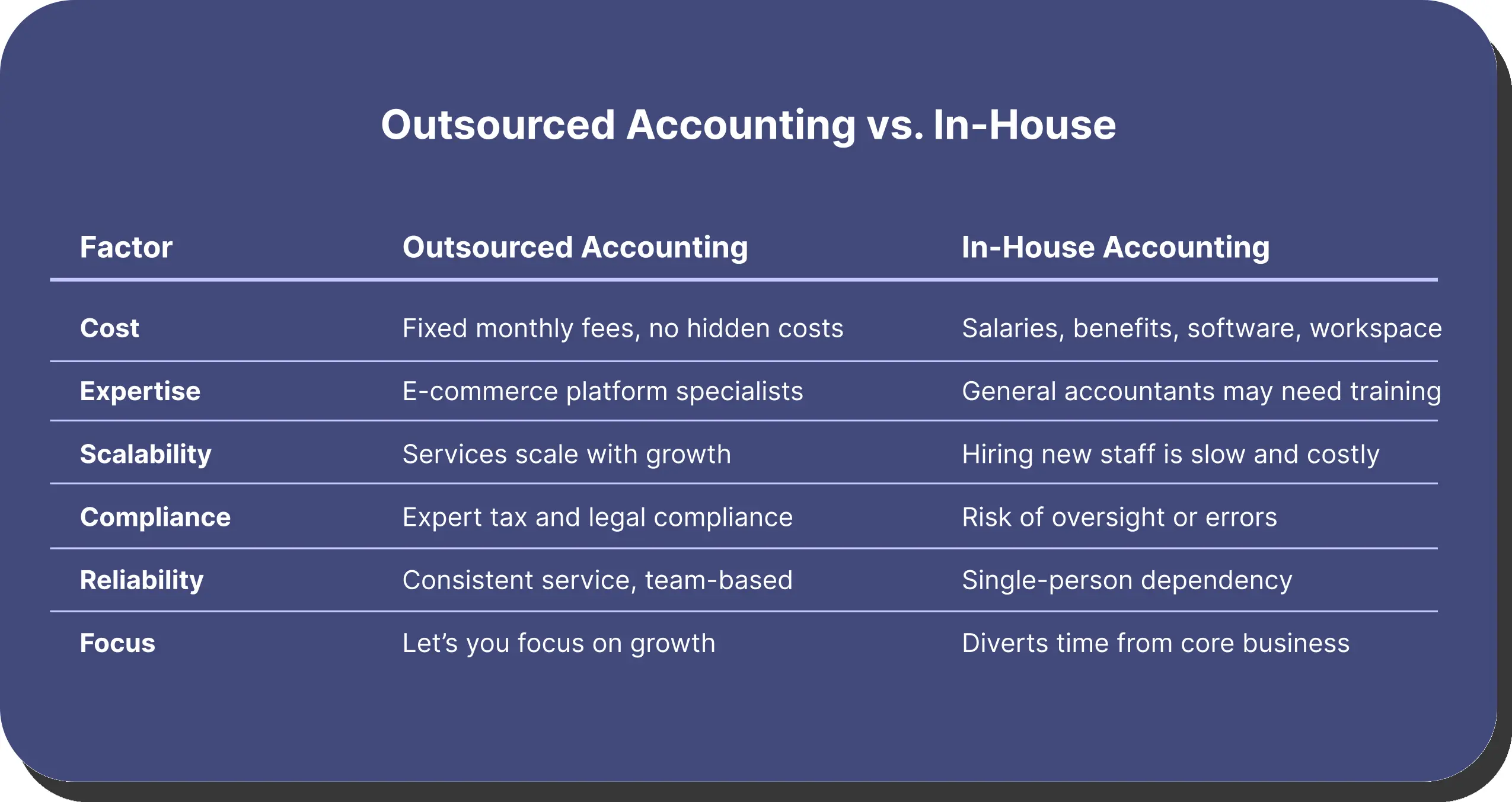

Outsourced Accounting vs. In-House: Which is Right?

For most U.S. e-commerce stores, outsourcing provides flexibility, cost efficiency, and expert guidance especially when you’re growing or expanding internationally.

Turn Numbers into Growth

E-commerce success isn’t just about driving sales, it’s about understanding and leveraging your numbers. Accurate accounting gives you a real picture of which products, channels, and campaigns are truly profitable. With the right systems and expertise, you can make decisions confidently, reduce costly errors, and spot opportunities before your competitors do.

Outsourcing your e-commerce accounting brings precision, efficiency, and scalability. You get timely insights into cash flow, inventory, and taxes without drowning in spreadsheets or platform reports. This clarity frees you to focus on innovation, marketing, and expanding your business rather than getting bogged down in financial minutiae.

In today’s fast-moving U.S. e-commerce market, having clean, accurate, and actionable financial data isn’t a luxury it’s a strategic advantage. Smart business owners use specialized accounting to streamline operations, protect compliance, and drive sustainable growth, turning complex financial data into a clear roadmap for success.

Shekhar Mehrotra

Founder and Chief Executive Officer

Shekhar Mehrotra, a Chartered Accountant with over 12 years of experience, has been a leader in finance, tax, and accounting. He has advised clients across sectors like infrastructure, IT, and pharmaceuticals, providing expertise in management, direct and indirect taxes, audits, and compliance. As a 360-degree virtual CFO, Shekhar has streamlined accounting processes and managed cash flow to ensure businesses remain tax and regulatory compliant.

You might also like:

- Sales Tax on Alcohol in Restaurants: Your Complete Guide

- How Smart Accounting Can Help You Price Your Plates

- WIP Reports: Your Construction Project's Financial GPS

- The Accounting Reality Behind Claim Denials That Quietly Drain Clinic Revenue

- 9 Practical Strategies to Improve Cash Flow for Small Businesses

Listen Exclusive Podcast On